Zenith Bank Transfer Charges

Zenith Bank is one of the leading financial institutions in Nigeria, offering a wide range of banking services to its customers. One of the services provided by the bank is the transfer of funds between accounts, whether within the bank or to accounts in other banks. However, these services come at a cost, and customers are required to pay transfer charges depending on the type of transfer they make.Zenith Bank Transfer Charges

In this article, we will be discussing Zenith Bank transfer charges, including the different types of transfers, the fees associated with each, and some tips to help customers minimize these charges.NYSC Portal

👉 Relocate to Canada Today!

Live, Study and Work in Canada. No Payment is Required! Hurry Now click here to Apply >> Immigrate to CanadaRead Also: GTbank Transfer Charges to other Banks

Types of Transfers

There are two main types of transfers that Zenith Bank offers: intra-bank transfers and interbank transfers. Intra-bank transfers refer to transactions between accounts within Zenith Bank, while interbank transfers involve sending money to accounts in other banks.Good morning My Love Message

Intra-Bank Transfers

Intra-bank transfers are transactions made between accounts held in Zenith Bank. These transfers can be made using various methods, including mobile banking, internet banking, ATM, and branch banking. The transfer charges for intra-bank transactions depend on the channel used for the transaction. For instance, transfers made through mobile banking are generally cheaper than those made through branch banking.Information guide Nigeria

Read Also: How to Transfer Money From Bank to Fidelity Brokerage Account

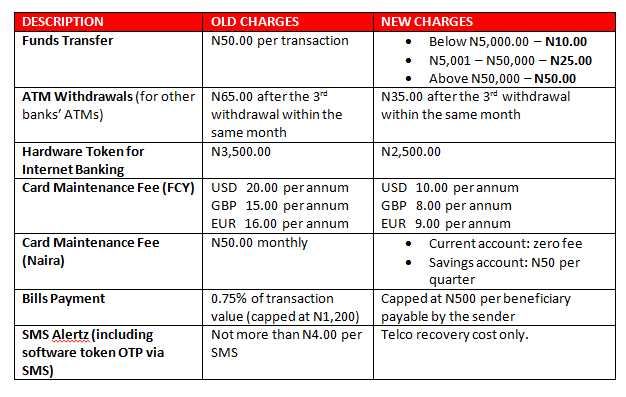

The table below shows the different transfer charges for intra-bank transactions, depending on the channel used:

| Channel | Transfer Charges |

|---|---|

| Mobile Banking | N50 per transfer |

| Internet Banking | N50 per transfer |

| ATM | N100 per transfer |

| Branch Banking | N105 per transfer |

Read Also: How to Create Pin for Fidelity Bank Mobile Transfer

Interbank Transfers

Interbank transfers are transactions made between Zenith Bank accounts and accounts in other banks. These transfers can be made using various methods, including mobile banking, internet banking, and branch banking. The transfer charges for interbank transactions also depend on the channel used for the transaction.

The table below shows the different transfer charges for interbank transactions, depending on the channel used:

| Channel | Transfer Charges |

|---|---|

| Mobile Banking | N50 per transfer |

| Internet Banking | N50 per transfer |

| Branch Banking | N210 per transfer |

It is important to note that Zenith Bank charges an additional fee of N52.50 for all interbank transactions. This fee is known as the Nigeria Inter-Bank Settlement System (NIBSS) fee and is charged by all banks in Nigeria for interbank transactions.10 best money transfer apps in Nigeria

👉 Relocate to Canada Today!

Live, Study and Work in Canada. No Payment is Required! Hurry Now click here to Apply >> Immigrate to CanadaRead Also: How To Transfer Money from Zenith Bank To Bet9ja Account

Tips to Minimize Transfer Charges

Here are some tips to help Zenith Bank customers minimize their transfer charges:Check JAMB result

- Use Mobile or Internet Banking: Transactions made through mobile or internet banking are generally cheaper than those made through branch banking or ATM.

- Use Intra-Bank Transfers: Whenever possible, try to use intra-bank transfers as they are generally cheaper than interbank transfers.Romantic love message

- Use the Right Account Type: Some Zenith Bank account types offer free transfers, so it is important to choose the right account type if you make frequent transfers.JAMB portal

- Plan Ahead: If you need to make multiple transfers, try to plan them ahead of time to minimize the number of transactions and reduce transfer charges.20 Best TV Stands in Nigeria and their Prices and Pictures

Read Also: UBA Bank Transfer Charges

Conclusion

In conclusion, Zenith Bank transfer charges depend on the type of transfer and the channel used for the transaction. Customers can minimize these charges by using mobile or internet banking, choosing the right account type, and planning ahead. It is also important to note that the Nigeria Inter-Bank Settlement System (NIBSS) fee is charged for all interbank transactions, and this fee is not exclusive to Zenith Bank.

Check: JAMB RESULT

Check and Confirm: How much is Dollar to Naira