How To Transfer Money From GTBank Ghana To GTBank Nigeria

Read Also: How To Reset My Zenith Bank Transfer Pin

👉 Relocate to Canada Today!

Live, Study and Work in Canada. No Payment is Required! Hurry Now click here to Apply >> Immigrate to CanadaStep 1: Log in to Your GTBank Ghana Internet Banking Account

To begin the transfer process, you need to log in to your GTBank Ghana internet banking account. You can do this by visiting the GTBank Ghana website and clicking on the internet banking login button. Enter your login details, including your user ID and password, to access your account.

Step 2: Initiate the Transfer

Once you’re logged in, select the “Transfers” option from the main menu. Next, choose “GTBank Nigeria” as the beneficiary bank, and select the account you want to transfer the money to.NYSC Portal

Step 3: Enter the Recipient’s Account Details

You’ll need to provide the recipient’s account details, including their name, account number, and branch code. Make sure that the details you enter are accurate to avoid any delays or issues with the transfer.

Read Also: Zenith Bank Joint Account Requirements

Step 4: Enter the Amount and Confirm the Transfer

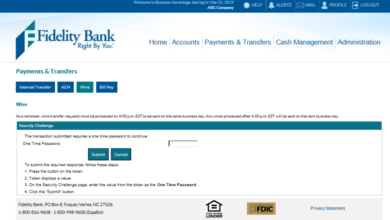

After entering the recipient’s account details, enter the amount you want to transfer and confirm the transfer. You may be prompted to enter a transaction PIN or use a token to verify the transfer.Check JAMB result

Step 5: Wait for the Transfer to Be Processed

Once you’ve confirmed the transfer, the funds should be debited from your GTBank Ghana account and credited to the recipient’s GTBank Nigeria account within a few hours. However, processing times may vary depending on the time of day and any banking holidays.Romantic love message

Read Also: Zenith Bank Transfer Code To Betking

How to Transfer Money from Ghana to Nigeria Bank Account

Transferring money from a bank account in Ghana to a bank account in Nigeria can be done through various channels. Here are the steps to transfer money from Ghana to Nigeria:

- Visit your bank in Ghana: The first step is to visit your bank in Ghana and request a transfer to Nigeria. You will need to provide the recipient’s bank account details, including the account name, number, and the bank’s name.

- Provide a valid ID: Your bank may require you to provide a valid identification document, such as a passport or national ID card, before processing the transfer.20 Best Hamper Basket and their Prices in Nigeria

- Fill out a transfer form: Fill out a transfer form, providing the recipient’s bank account details, the amount to be transferred, and any other required information.JAMB portal

- Pay transfer fees: Your bank may charge a fee for the transfer, which will be deducted from your account. The fee may vary depending on the amount being transferred and the bank’s policies.

- Confirm the transfer: Once you have filled out the transfer form and paid the transfer fee, your bank will process the transfer. You will receive a confirmation message or receipt indicating that the transfer has been completed.

- Wait for the funds to arrive: The funds should arrive in the recipient’s bank account within a few business days. However, processing times may vary depending on the banks involved and any banking holidays.

Read Also: GTBank FX transfer charges

👉 Relocate to Canada Today!

Live, Study and Work in Canada. No Payment is Required! Hurry Now click here to Apply >> Immigrate to CanadaAlternative options for transferring money from Ghana to Nigeria include using online money transfer services such as Western Union or MoneyGram, which allow you to send money from Ghana to Nigeria using your computer or mobile device. Some banks may also offer online banking services that allow you to initiate the transfer from your computer or mobile device.Information guide Nigeria

How to Check my GTB Domiciliary Account Balance

To check the balance of your GTBank domiciliary account, you can follow these steps:

- Visit the GTBank website at www.gtbank.com and click on the “Internet Banking” button.

- Enter your login details (username and password) and click on the “Login” button.

- Once you are logged in, click on the “Accounts” tab and select “Domiciliary Account” from the drop-down menu.

- Your account balance should be displayed on the screen.Good morning My Love Message

Alternatively, you can also check your account balance by visiting any GTBank branch or by using the GTBank mobile app.10 Best Asus Laptops in Nigeria and their Prices