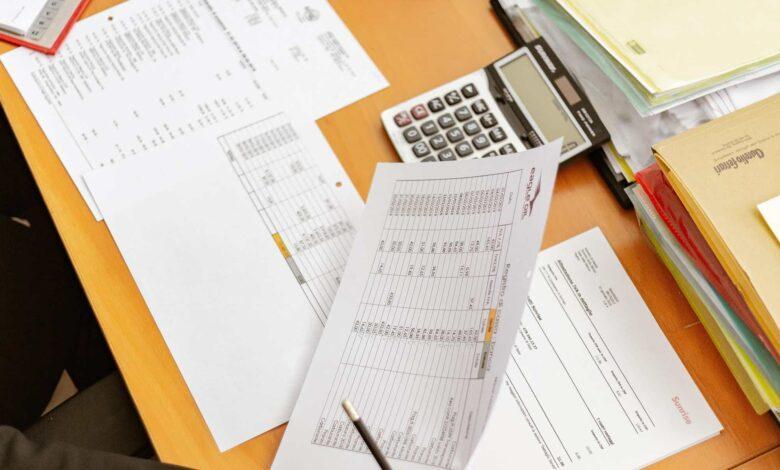

Accounting Auditor Job Description, Roles/Responsibilities, and Qualifications

Accounting auditor job description: Auditors are in charge of tracking a company’s cash flow and accounts to verify that they are recorded and processed correctly, that assets are protected through suitable control methods, and that financial records comply with legal standards. Auditors can serve as internal auditors, external auditors, or independent auditors in both the public and commercial sectors.

The vast majority of auditors hold a Bachelor’s degree in accounting or finance. Many auditors also hold the Certified Public Accountant (CPA) credential, which is achieved by taking a national exam and completing a certain amount of college coursework hours. Auditors must have a sharp eye for detail, the ability to work well under pressure, and a talent for problem-solving.Accounting Auditor Job Description

👉 Relocate to Canada Today!

Live, Study and Work in Canada. No Payment is Required! Hurry Now click here to Apply >> Immigrate to CanadaAccounting is a popular career path for those who have an analytical mindset and a desire to work with commercial or personal financial data. An accountant’s primary responsibility is to do in-depth research and correct reporting on financial records, which is typically done as a support function to a chief financial officer (CFO) or a company’s finance department. Accountants also deal directly with individuals to evaluate financial records for individual or business tax filing. An accountant schooled in the public or private sector can work in a small, medium, or big company, as an independent in their own firm, or as a consultant or contractor to enterprises or nonprofit organizations.

Accountants are concerned with the minute and demanding details, daily operations, financial accuracy, and taxes.

Read Also: Sonography Job Description, Roles/Responsibilities, and Qualifications

Responsibilities of an Accounting auditor

- Examines the accuracy of assigned financial records and statements. NYSC Portal

- Analyzes financial data and makes recommendations as needed to increase accuracy, efficiency, and cost-cutting.

- Examines the budget and general ledger for allocated departments and accounts to ensure that money is available and expenditures are properly assigned.

- Examines and/or aids in the preparation of financial statements and records for federal, state, and internal auditors, as well as other similar people.

- As needed, aids with accounting activities and financial record adjustments.

- Identifies and proposes updates to accounting systems and practices as needed.

- Assists with the compilation of annual financial reports as needed.

- Review available information and do research to develop audit objectives, plans, and scope.

- Assist in the design, implementation, and maintenance of internal audit procedures and risk assessment processes. 15 Best Women’s Thongs in Nigeria and their Prices

- Prepare audit findings, audit reports, and recommendations.

- Ensure that all appropriate plans, policies, and standards are followed.

- Keep up to date on industry changes and best accounting and auditing practices.

- Ensure the accuracy of financial data. Information Guide Nigeria

- Audit suggestions should be followed up on.

Read Also: Periodontist Job Description, Roles/Responsibilities, and Qualifications

Roles of an Accounting auditor

- Examine financial statements to ensure they are correct and in accordance with applicable laws and regulations.

- Calculate tax liabilities, prepare tax returns, and guarantee that taxes are paid correctly and on time.

- Examine accounting books and systems for efficiency and compliance with standard accounting processes.

- Organize and keep financial records Romantic Love Message

- Examine financial operations and give recommendations to management on best practices.

- Make suggestions on ways to save costs, increase revenues, and increase profitability.

Read Also: Civil Engineer Job Description, Roles/Responsibilities, and Qualifications

Accounting auditor job qualifications/skills

- A bachelor’s degree in accounting, finance, or a related subject is required. CPAs are preferred.

- 3-6 years of experience in financial accounting, auditing, or a combination of the two, ideally in public accounting Top 25 managerial round interview questions with sample answers

- Accounting, banking rules, regulations, and internal controls are all well-understood.

- Excellent knowledge of audit theories, principles, and practices

- Knowledge of general accounting practices and approaches

- Strong interpersonal skills, critical thinking abilities, and time management abilities are required.

- Excellent verbal and written communication skills

- Working in a collaborative environment requires comfort.

- Microsoft Office application proficiency JAMB Portal

- Expertise in both financial accounting and cost accounting in general.

- Understand generally accepted accounting principles and be able to stick to them.

- Able to use accounting software well.

- They are very organized and pay close attention to detail.

- Excellent communication skills both in writing and in person.

- Skilled with Microsoft Office Suite or software that is similar.

Read Also: Endocrinologist Job Description, Roles/Responsibilities, and Qualifications

Accounting auditor Salary structure in the USA

How much does an Accounting Auditor make in the United States? In the United States, the average auditor compensation is $57,256 per year or $29.36 per hour. Entry-level salaries begin at $31,997 per year, with most experienced workers earning up to $92,698 per year.

Types of Accounting auditor

External Audits

👉 Relocate to Canada Today!

Live, Study and Work in Canada. No Payment is Required! Hurry Now click here to Apply >> Immigrate to CanadaOutside audits can be incredibly beneficial in removing any prejudice in examining the health of a company’s financials. Financial audits are conducted to determine whether there are any material misstatements in the financial accounts. An unqualified, or clean, auditor’s judgment gives users of financial statements confidence that the figures are accurate and comprehensive. As a result, external audits enable stakeholders to make better, more informed judgments about the organization being audited.

External auditors adhere to a different set of criteria than the firm or organization that hires them to undertake the work. The principle of independence of the external auditor is the most significant distinction between internal and external audits. When third-party audits are undertaken, the ensuing auditor’s judgment on the items being audited (a firm’s financials, internal controls, or a system) can be straightforward and honest without influencing everyday work relationships within the company. Good Morning My Love Message

Internal Audits

Internal auditors are engaged by the company or organization that they audit, and the audit report is sent directly to management and the board of directors. Consultant auditors, who are not hired internally, apply the company’s standards rather than a distinct set of standards. These auditors are used when an organization lacks the in-house resources to audit specific aspects of its own operations.

Internal audit results are used to make managerial changes and improve internal controls. Internal audits are performed to guarantee compliance with laws and regulations, as well as to aid in the maintenance of accurate and timely financial reporting and data collecting. It also helps management by discovering problems in internal controls or financial reporting before it is reviewed by external auditors.

Read Also: Mri Tech Job Description, Roles/Responsibilities, and Qualifications

Audits by the Internal Revenue Service (IRS)

The Internal Revenue Service (IRS) also conducts audits on a regular basis to ensure the accuracy of a taxpayer’s return and specific transactions. When the IRS audits a person or company, it is usually seen as evidence of some type of wrongdoing on the part of the taxpayer. Being chosen for an audit, on the other hand, is not always indicative of wrongdoing.

Random statistical formulas that analyze a taxpayer’s return and compare it to similar returns are typically used by the IRS to select auditees. A taxpayer may also be chosen for an audit if they have any dealings with another person or company who had tax errors discovered during their audit.

Conclusion

We hope that you will find this article useful. You can also use this as a guide to know the job description of an accounting auditor if you are hoping to work as one.

Check JAMB Result

Check and Confirm: How much is Dollar to Naira